Rest Easy in Retirement Ice Cream Social & Seminar

FREE Event: Presenting local experts to help you take the guesswork out of your Golden Years!

DATE: April 24th

TIME: 1:00PM

LOCATION: Encore Senior Center | 312 Alumni Ave; Harleysville, PA 19438

GET YOUR QUESTIONS ANSWERED BY EXPERTS!

- Can I cancel my insurance when I downsize from my “family home”? What do I do with all the stuff in my home that I can’t keep?

- How can I protect, organize, and transfer my wealth? What are my options when it comes to senior healthcare?

- How do I decide when it is time to downsize or sell my home? What type of tax consequences do I need to understand?

- How can I ensure that my family trust or inheritance is set up properly?

- What do I need to know about reverse mortgages?

MEET THE PROFESSIONALS

215-892-2178

shelbysellshomespa@gmail.com

Shelby is a passionate and dedicated Realtor that takes extreme enjoyment in her work. She gets to help others in what is possibly the most important as well as largest financial decision they may make in their life. Selling, buying or investing in real estate can be a confusing time with possible angst – but it doesn’t have to be! Shelby takes pride in the fact that she works hard to be an advocate for her clients so that everyone she works with in a real estate transaction knows that her goal is to assist all parties get to a win/win situation.

215-855-5743

McKee@edwardjones.com

Tom McKee values personal relationships based on trust and a deep understanding of your unique financial needs. Born and raised in the Philadelphia area, he has called Lansdale home since 2010, alongside his wife, Crystal, and their children. They’ve developed strong roots here, and are active in the community. As a family, they enjoy cooking, watching football, skiing or snowboarding, and spending time together. He understands that family means everything, and is committed to helping you build your financial future, just like he wants to do for his family.

215-997-9440

rsmyrl@smyrl-insurance.com

Bob joined his family’s insurance business in 1986 and leads Smyrl Insurance today as a high-integrity agency known for providing knowledgeable, personalized service. As a Certified Insurance Counselor (CIC), he is committed to educating clients so that they can make informed and proactive decisions about their insurance coverage. Clients appreciate that Bob will take time to learn about their circumstances, ask questions to get the full picture, and give a thorough explanation of each option. He focuses on making sure clients have the right coverage so they aren’t faced with disappointing surprises. He considers it a privilege to be the trusted insurance agent for the next generation of many client families. Bob and his wife live in Hatfield, where they are active in several local community and youth organizations, especially those in which their three sons participated as kids.

610-847-5422

darla@yourtasksourtime.com

Darla Pompilio is a Senior Move Manager, Professional Organizer and founder of Your Tasks – Our Time, LLC located in Pennsylvania and New Jersey. She has been providing senior moves, relocation and organizing services for over 15 years. She is keenly aware of the challenges of downsizing and relocating a lifetime of memories. Darla has made it her mission to minimize these difficulties by guiding clients and their families through this daunting process with ease and grace.

215-822-9004

contact@jeremymittman.com

Jeremy Mittman has over 30 years of helping families and businesses achieve their goals of protecting and transitioning their wealth in PA. He grew up in Montgomery County with his five siblings. Jeremy attended Wissahickon high School where he was a member of the National Honor Society as well as a varsity wrestler. He went on to continue both his education and interest in sports at Brown University. Jeremy graduated with a BA in Economics and a varsity letter in wrestling. After graduation, Jeremy went on to pursue his career by attending Villanova Law School. He has been practicing law since 1993.

267-664-5311

susanlsloan@gmail.com

Susan Sloan has been working in health insurance and Medicare for over 30 years. Her background includes working for both a major health insurer and working in hospital billing before going into health insurance sales close to 20 years ago. Service is what matters most to her. It is easy to sell a health plan, whether it is for Medicare or group or individual insurance. What separates the salesperson from the health insurance advocate and broker is the service you receive afterwards. Susan is here any time you have questions or concerns about your coverage and will be there with you when a claim or billing issue occurs so that you don’t have to go it alone.

267-932-8365 x100

colettem@cmbasolutions.com

Colette is an experienced Senior Executive Accountant with a demonstrated history of working in the accounting industry. Skilled in Tax Preparation and Planning as well as Management Accounting. Strong accounting professional with a Master of Science focused in Personal Financial Planning and Counseling from The University of Alabama as well as Bachelors of Science in Business with a focus in Finance. She is a Certified Management Accountant, Certified QuickBooks ProAdvisor and a member of the National Association of Enrolled Agents (NAEA), and the Institute of Management Accountants (IMA).

215-681-8407

mikethompson@nafinc.com

Mike Thompson is a top-producing mortgage professional, focused on meeting the individual needs of every customer. He is highly skilled at solving every family’s unique mortgage needs. Mike and his business partner collectively have over 30 years of experience serving clients throughout Pennsylvania, New Jersey, and Delaware. His mission is to create an experience of excellence with each transaction, earning the opportunity for repeat and referral business. Mike is proud to have helped second and even third generations of families achieve the American dream of home ownership.

Retiree Plans and Cobra are not Creditable Coverage for Medicare

DID YOU KNOW? Retiree Plans and Cobra are not Creditable Coverage for Medicare

Too many retirees are getting hit with late enrollment penalties for Medicare

Too many retirees are getting hit with late enrollment penalties for Medicare

Too many retirees are getting hit with late enrollment penalties for Medicare, finding themselves with medical bills that are not being paid and being talked into plans that, frankly, don’t work for them. Once an employee becomes a retiree of a company, they are often handed over to a third-party benefits administrator who really doesn’t take the time to explain their rights and what they need to do and when they need to do it.

I have been on many calls with people who are either retiring, or are retired, from a company and then handed off to a third-party benefits administrator who then transfers us to one person, then to another, then to another, and then back to the original person. In the meantime, the retiree, my client, is feeling frustrated, angry, and scared, that they will end up being penalized for just having decided to take the step of retirement. This is insane and it happens repeatedly for people in mid-size, large, and often government related industries.

If you do not take the steps to enroll in Part B when first eligible, you will owe a late enrollment penalty!

If you do not take the steps to enroll in Part B when first eligible, you will owe a late enrollment penalty!

Did you know that COBRA and RETIREE Insurance are not forms of job-based health insurance coverage and, if you do not take the steps to enroll in Part B when first eligible, you will owe a late enrollment penalty? Medicare requires that you show continuous creditable coverage if you and your spouse are covered by group-based health insurance and are staying with that coverage and not enrolling in Medicare Part B. What many companies fail to explain well to their retirees is that group coverage only counts as creditable while they are working for that company. Once they retire, they must enroll in Medicare Parts A and B to avoid late enrollment penalties. Please click on this link (or copy and paste it) to read further: Medicare-Part-B-SEP.docx (medicarerights.org).

Late enrollment penalties for Part B can add up over time and can cause you to have much higher than expected medical costs. It also can affect when you can enroll in Medicare and could cause penalties for prescription drug coverage as well.

Employers are relying more and more on third party benefits administrators to relay information to their retirees and those third party benefits people are handling benefits for many companies and unions and are not communicating well with the retirees. Employees need to be demanding more of their company, their union, and their government to make sure that they are not left with high bills that they cannot afford because consistent and understandable information regarding their Medicare rights was not made available to them.

How Much Does a Health Insurance Agent Cost?

How Much Does a Health Insurance Agent Cost?

Insurance plans are extremely difficult to understand without a helpful agent.

Insurance plans are extremely difficult to understand without a helpful agent.

Costs are a serious concern for people who need to shop for individual or Medicare insurance plans. Some are worried that even just calling an insurance agent will come at a cost, so they attempt to manage the process on their own. What those individuals quickly learn is that insurance plans are extremely difficult to understand without a helpful agent to interpret them.

It costs you nothing to work with a health insurance agent in Pennsylvania!

It costs you nothing to work with a health insurance agent in Pennsylvania!

Here’s the good news: it costs you nothing to work with a health insurance agent in Pennsylvania. In fact, you may be able to save money, time, and many headaches by working with an agent. There are several reasons why working with a health insurance agent can make insurance and healthcare more affordable.

Insurance Agent Fees are Covered in Premiums

Independent insurance agents get paid commissions by the health insurance companies. These agent commissions are built right into the premium you pay for your plan. This means that even if you are not working with an insurance agent, you are paying for one. But you are missing the guidance and service an agent provides.

Because agents are paid commissions through premiums, do they simply steer all clients towards the highest paying plans? The short answer to this is no. Your health insurance agent has a responsibility to work in your best interest, not their own. You can go over the commission they will receive in each plan you are reviewing, and you will quickly notice that the agent’s recommendations are in alignment with your needs rather than their potential earnings.

Insurance Agents Look at All of Your Costs

While the health insurance premiums may be your focus when pricing plans, a knowledgeable agent is looking at a bigger picture of costs. They’ll explain what you will pay to actually use your plan in a medical setting. Your premium, though it’s the known upfront cost, is just one element of your overall healthcare expenses.

Experienced health insurance agents will ask you about how you have used healthcare in the past and how you expect to continue using it. They will explain your deductibles, co-pays, out-of-network costs, and limits to coverage. Once you see the entire scope of coverage for your premium, you will have a better sense of what healthcare will really cost under each plan.

Insurance Agents Save You Time and Frustration

Today’s plans are far more complex.

Today’s plans are far more complex.

Health insurance policies used to be so straightforward that you could call any medical provider and find out if they accepted your plan. Today’s plans are far more complex. Providers may participate with only certain policies under a given insurer. The insurers offer some plans with a large network of providers, but others – of very similar sounding names – with only a narrow network of providers. Whether you call the provider directly or search online, it’s easy to get confused about whether or not a given provider accepts your specific plan. This is especially common with Medicare Advantage Plans, Individual and Family Insurance Plans that are sold either on or off the Marketplace, and small group plans. Once enrolled, you are typically locked into a plan for one year. It’s very frustrating to discover that the providers you thought were in the plan’s network are actually not covered.

An experienced local health insurance agent helps you identify the right plan for your needs and also helps you navigate the plan you choose. Our job is to interpret the coverage, costs, and network providers so that you can make the most informed decision about enrollment. At Real Health Quotes, we continue providing helpful guidance even after you enroll in the plan. Whenever you have a question about providers, coverage, premiums, or a claim, you can give us a call. Our job is to make sure you know what to expect in your healthcare so that you can avoid the cost (in time or money) of mistakes and correcting them.

Our job is to make sure you know what to expect in your healthcare so that you can avoid the cost (in time or money) of mistakes and correcting them.

Our job is to make sure you know what to expect in your healthcare so that you can avoid the cost (in time or money) of mistakes and correcting them.

How Much Will Medicare Cost Me?

How Much Will Medicare Cost Me?

For most people approaching age 65, enrolling in Medicare will be their very first experience of purchasing health insurance on their own. They are typically more familiar with participating in an employer sponsored plan. Medicare is something very new to them, and all they know so far is that they could be penalized for enrolling late or incorrectly and that there are different “parts” they need to review.

The main concern for most individuals is cost. Having paid for health insurance all of their working life, and knowing that healthcare costs rise as we age, they are worried about how they will pay for insurance in their later years. Medicare is specifically designed for aging individuals and has many subsidies due to the tax dollars those individuals have already paid into the system. Each Medicare part is priced separately. Let’s start with the cost of original Medicare, which is Part A and Part B.

How Much Will Medicare Part A Cost Me?

Medicare Part A is hospital insurance, and most people (with some exceptions) will not need to pay a premium for it. Because there is typically no premium, it is wise to enroll in Medicare Part A at eligibility (up to 3 months before one’s 65th birthday) even if the individual is still participating in an employer’s plan.

Medicare Part A premiums are covered because either the individual or their spouse has already paid Medicare taxes for at least 10 years while earning W-2 income. If that tax-paying history does not exist, the individual will pay monthly premiums for Medicare Part A. This often affects recent immigrants, and the payment is either $278 or $506 in 2023.

Medicare Part A does have deductibles and copays that individuals will pay out of pocket for inpatient hospital care, skilled nursing services, and home health care medical equipment. The deductible in 2023 for an inpatient hospital stay is $1,600. Copayments are based on the amount of time spent receiving care. Home health care and hospice care covered under Medicare do not have a deductible or copay.

How Much Will Medicare Part B Cost Me?

Medicare Part B is outpatient medical insurance. Medicare Part B covers doctor visits, lab work, durable medical equipment, home health care, Part B drug administration, outpatient surgery, and other outpatient care. This premium is $164.90 per month in 2023 for individuals earning $97,000 or less and married couples filing jointly earning $194,000 or less. Premiums are higher for those who earn more.

The premiums are based on the income earned 2 years prior to the current year, so premiums can change from year to year. Individuals who are eligible for Medicaid, or state assistance due to low income, may not have Medicare Part B premiums. If someone has a life event that impacts their income for assessing Medicare premiums, they can file Form SSA-44 to try to pay a lower amount. Medicare Part B also has deductibles and copayments depending on the type of care, including a low annual deductible.

How Much Will Medicare Part C Cost Me?

Medicare Part C is not an actual benefit, but rather the classification of Medicare Advantage plans. These plans are sold by private insurers and offer many options for coverage, benefits, and premiums. No one is required to enroll in a Medicare Advantage plan.

Medicare Advantage plans replace original Medicare.

Medicare Advantage plans replace original Medicare.

Medicare Advantage plans replace original Medicare. They are not Medicare Supplement plans. Through deceptive marketing practices, people are led to believe that Medicare Advantage supplements their original Medicare coverage, and this is simply not true. It is a completely separate product. It is always vital to speak with a trusted Medicare insurance agent about existing coverage and what has been offered or promised.

How Much Will Medicare Part D Cost Me?

Medicare Part D covers prescription drug plans. These plans are not technically required, but there is a penalty that can extend over a lifetime for not enrolling. Alternative coverage such as VA coverage, TriCare, creditable employer prescription drug coverage, or low income assistance will exempt an individual from the penalty. If someone does not enroll in prescription drug coverage during open enrollment, or within 63 days of losing creditable coverage, they will be fined 1% of the average annual cost of a Medicare prescription drug plan for each month of coverage missed every month for life.

What are the Financial Penalties of Not Enrolling in Medicare?

Late enrollment penalties are assessed if a person does not have coverage that is at least as good as original Medicare and misses the open enrollment period. The penalty will be assessed for either double the number of years of coverage missed (Part A) or the lifetime of coverage (Part B and D). To avoid unnecessary penalties, always take advantage of the initial enrollment period at age 65.

At Real Health Quotes, we are experienced advisors who will answer all of your Medicare questions

At Real Health Quotes, we are experienced advisors who will answer all of your Medicare questions

There is no cost to talk to an insurance agent about Medicare. At Real Health Quotes, we are experienced advisors who will answer all of your Medicare questions, help you understand the bottom line to everything you’ve seen and heard about Medicare, and guide you through the enrollment process and beyond. You do not need to figure out Medicare all on your own.

Contact us to learn more about your options and explore the best coverage for you.

Want to learn more about Medicare?

Sign up for our “What You Need to Know about Medicare in 6 Easy Steps” course! Learn more and sign up here.

Health Insurance Costs So Much – Can I Get Anything Cheaper?

Don't judge a book by its cover...

I just had a phone call today from an insurance professional in auto/homeowners insurance. He had a non-ACA insurance health plan through a life insurance company. It is an indemnity plan (meaning it pays you back money when you go to see a medical provider). There are no networks and the premium is very affordable and on the surface it looks great.

Here is the situation that may change your mind about it, however. His problem was that his wife was pregnant and had to move over to an Affordable Care Act (ACA) compliant plan because their Indemnity Policy does not cover pregnancy / childbirth. She was able to do so and the family, because of a special election period due to pregnancy or birth can also move over to that plan ( a local Blue Cross Plan). Their income is too high to get a subsidy so the premium for all of them would be over $1400 per month (definitely why I always complain about affordability in the Affordable Care Act). It might be a politician’s definition of affordable but it is not mine and is also not many of my client’s ideas either and this is a problem that is never addressed by the media.

The crux of the matter...

If he does not take that option of going to the Affordable Care Act Plan for the entire family, he would either have to forego coverage for his wife on the ACA compliant plan OR he would have to pay both the premium for the Indemnity Plan for the entire family – including his wife – and pay for her separately under the Affordable Care Act compliant plan. The Indemnity Plan will not allow them to drop family coverage in the middle of the year. They either cover everyone ( and this will not affect the ACA compliant plan because an Indemnity Plan is not health insurance) and her pregnancy would not be covered, or they have to pay for the ACA plan for his wife and pay the Indemnity Plan for the entire family, or they have to drop the Indemnity Policy and take the ACA Plan – through a local Blue Cross – for the entire family at $1400 per month. Not amazing choices.

My advice...

My advice is that they should take the ACA Blue Cross Plan for the entire family. I know the premium is high but… and this is a big but… health issues, including pregnancy, come up all the time and an indemnity policy just may not be there for you when you really need it. In my own family I have a son, who, at age 25 was diagnosed with a terminal illness out of the blue. He had always been perfectly healthy and we never expected a terminal illness at such a young age. Luckily, he had good, full, health insurance. He is still alive and fighting for his life 7 years later.

Your health is the most important thing that you have.

Your health is the most important thing that you have.

Your health is the most important thing that you have. You can have all the money, all the cars, all the sports tickets, and on and on but what good are they to you if you can’t walk, or talk, or have to live in constant pain, because you didn’t take care of your health because of the cost?

The Biden Administration Acts Quickly To Strike Down The Texas Federal Judge’s Ruling On Preventive Services

With the ruling coming in on Thursday, March 30th from U.S. Judge Reed O’Connor, of the U.S. Northern District Court of Texas, apparently striking down mandated $0 cost coverage under the Affordable Care Act (Obamacare) the Biden Administration reacted quickly filing an appeal against that decision.

“Preventive care is an essential part of healthcare: it saves lives, saves families, money, and improves our nation’s health.” Said Kamara Jones, a Health and Human Services Spokesperson on Thursday evening. She also stated that “Actions that strip away this decade old protection are backwards and wrong.”

I am sure there will be more that we will hear regarding this and other changes to the Affrodable Care Act. We will keep you updated.

Pandemic Emergency Coverage for Medicaid is ending

The PA Department of Human Services says the following:

Starting April 1, 2023, if you get your health insurance from the state, you will need to complete your renewal every year when it is due to make sure you are still eligible to receive Medicaid or CHIP.

You will not automatically [or immediately] lose health coverage.

No one will lose their health coverage without having a chance to complete a renewal or update their information. But, if you do not return your renewal when it is due, you may risk losing your coverage.

To check your renewal date or submit your renewal online, here's the link they offer:

https://www.compass.state.pa.us/compass.web/Public/CMPHome

Content provided from: https://www.dhs.pa.gov/PHE/Pages/default.aspx

Surprise Out of Network Billing Loophole That Could Cost You A Lot of Money

I thought this might be important for everyone to read. This is from a story written by Harris Meyer on February 28th, 2023 by the Kaiser Health News of the Kaiser Family Foundation.

It is dangerous to assume that medical bills will be covered the way you might think they will be...

It is dangerous to assume that medical bills will be covered the way you might think they will be...

It is dangerous to assume that medical bills will be covered the way you might think they will be, especially if the provider is listed as out of network, even in an emergency situation. The “Surprise Billing Law” is supposed to protect patients and families from exorbitant charges when a true medical emergency exists and the hospital that you are taken to is an out of network facility. In the case below, a woman was sent to a non-participating hospital under her particular medical plan contract, but the hospital did have a broader participating contract with her insurer (though not necessarily her plan) and so the “Surprise Billing Law” did not apply to this situation. The family was going to be on the hook for many thousands of dollars while believing that the hospital admission, which was an emergency, would be covered under the in-network benefits, because this was a true medical emergency.

Out of network costs, and how they are handled by the insurers, need to be looked at by everyone who has commercial insurance, be it group, individual, or Medicare Advantage. This story took place in Washington state, and there can be differences in state laws, but this is also part of a larger federal law and gaps like this should be closed.

Surprise-Billing Law Loophole: When 'Out of Network' Doesn't Quite Mean Out of Network

By Harris Meyer • FEBRUARY 28, 2023

Laskey and her husband, Jacob, made the three-hour trip to the Swedish Maternal & Fetal Specialty Center-First Hill. Laskey had sought the clinic’s specialized care for this pregnancy, her second, after a dangerous complication with her first: The placenta had become embedded in the uterine muscles.

Back in Seattle, doctors at the clinic found Laskey’s water had broken early, posing a serious risk to her and the fetus, and ordered her immediate admission to Swedish Medical Center/First Hill. She delivered her son after seven weeks in the hospital. Though she was treated for multiple postpartum complications, she was well enough to be discharged the next day. Her son, who is healthy, went home a month later.

Laskey soon developed a fever and body aches, and she was told by her OB-GYN to go to Swedish’s emergency department. She said doctors there wanted to admit her when she arrived Aug. 20 and scheduled a procedure for Aug. 26 to remove a fragment of placenta that her body had not eliminated on its own.

Laskey, who had already spent weeks away from her 3-year-old daughter, chose to go home. She returned for the procedure, which went well, and she was home the same day.

Then the bills came.

The Patient: Danielle Laskey, 31, was covered by a state-sponsored plan offered by her employer, a local school district, and administered by Regence BlueShield.

Medical Service: In-patient hospital services for 51 days, plus a one-day stay that included a second placenta removal procedure.

Service Provider: Swedish Medical Center/First Hill, part of Providence Health & Services, a large, nonprofit, Catholic health system.

Total Bill: Swedish, through Regence, billed about $120,000 in cost sharing for Laskey’s initial hospitalization and about $15,000 for her second visit and procedure.

What Gives: The specialized clinic caring for Laskey before her hospital admission was in her insurance plan’s network. The clinic’s doctors admit patients only to Swedish Medical Center, one of the Seattle area’s only specialized providers for Laskey’s condition – which, given that connection, she assumed was also in the network.

So after being urgently admitted to Swedish, Laskey believed her bills would be largely covered, with the couple expected to pay $2,000 at most for their portion of in-network care because of her plan’s out-of-pocket cost limit.

...neither Swedish nor Regence told them before or during the two hospitalizations that Swedish was out of network

...neither Swedish nor Regence told them before or during the two hospitalizations that Swedish was out of network

It turned out Swedish was out of network for Laskey’s plan and, at first, Regence determined that Laskey’s hospitalizations were not emergencies. In November, a Regence case manager initially told Jacob that Laskey’s lengthy hospitalization was an emergency admission and out-of-network charges would not apply. But then she called back and said the charges would apply after all, because Laskey had not come in through the emergency department.

Both Washington state and federal laws prohibit insurers and providers from billing patients for out-of-network charges in emergency situations. The couple said neither Swedish nor Regence told them before or during the two hospitalizations that Swedish was out of network, and that they never knowingly signed anything agreeing to accept out-of-network charges.

Jacob, who works as a psychiatrist at a different hospital, said he mentioned the surprise billing laws to the case manager, but she replied that the laws did not apply to his family’s situation.

“Under the Washington state and federal balance-billing laws, the definitions of whether a provider is considered in network hinges on whether there is a contract with a specific provider,” Bach said.

Ashley Bach, a Regence spokesperson, confirmed to KHN that both stays now will be covered as emergency, in-network services, eliminating Swedish’s coinsurance charges. But in what appears to be contrary to the insurance commissioner’s stance, he said the bills had not violated state or federal laws prohibiting out-of-network charges in emergency situations because of the contract with Swedish covering all its plans.

On Jan. 27, two days after KHN contacted Regence and Swedish about Danielle Laskey’s case, a Regence representative called and informed her that her second hospitalization also would be reclassified as an in-network service.

On Jan. 13, Regence said it would grant the Laskeys’ appeal to cover the first hospitalization as an in-network service, erasing the biggest part of Swedish’s bill but still leaving the family on the hook for the $15,000 bill for Danielle’s second visit and procedure.

“Danielle had an emergency and Regence acknowledges it was an emergency, so she cannot be balance-billed,”

“Danielle had an emergency and Regence acknowledges it was an emergency, so she cannot be balance-billed,”

The office told KHN that the “participating provider” contract does not override the laws barring out-of-network charges in emergency situations. “Danielle had an emergency and Regence acknowledges it was an emergency, so she cannot be balance-billed,” said Stephanie Marquis, public affairs director for the Washington state Office of the Insurance Commissioner.

The Resolution: In December, the couple appealed Regence’s approval of Swedish’s outof-network charges for the 51-day hospitalization, claiming it was an emergency and that there was no in-network hospital with the expertise to treat her condition. They also filed a complaint with the state insurance commissioner’s office.

“We had no luck with Swedish taking any role or responsibility with regard to our billing or advocating on our behalf,” Jacob said. “They basically just referred us to their financial department to put us on a payment plan.”

Natalie Kozimor, a spokesperson for Providence Swedish, said the hospital disagreed with “some of the details and characterizations of events” presented by the Laskeys, though she did not specify what those were. She said Swedish assisted Danielle with her appeal to Regence.

After he declined to apply for the hospital’s financial assistance program, Jacob said Swedish also notified the couple in November that they had two months to pay or be sent to collections.

...since there was a contract specifying a 50% coinsurance rate when Swedish was out of network for a particular Regence plan, those laws legally may not apply...

...since there was a contract specifying a 50% coinsurance rate when Swedish was out of network for a particular Regence plan, those laws legally may not apply...

If there had been no contract between Regence and Swedish, the laws clearly would have prohibited those charges. But since there was a contract specifying a 50% coinsurance rate when Swedish was out of network for a particular Regence plan, those laws legally may not apply, Fiedler said.

Matthew Fiedler, a senior fellow at the University of Southern California-Brookings Schaeffer Initiative for Health Policy who studies out-of-network billing, said Laskey’s case seems to fall into a “weird” gray area of the state and federal laws protecting patients from out-of-network charges in emergency situations.

Ellen Montz, director of the Center for Consumer Information and Insurance Oversight at the Centers for Medicare & Medicaid Services, said that under the federal No Surprises Act the definition of a “participating” emergency facility that’s subject to the law’s surprise billing protections depends on whether the facility has a contract with the insurer specifying the terms and conditions under which an emergency service is provided to a plan member.

Experts said they had not heard of out-of-network providers evading surprise-billing laws by being contracted as “participating providers” until KHN asked about Laskey’s case.

Setting the terms with an insurer for providing its members emergency or other care appears to allow hospitals to sidestep new surprise-billing laws that prevent out-of-network providers from charging high, unpredictable rates in emergencies, according to government and private-sector medical billing experts.

What’s the difference between a hospital that’s “in network” and one that’s a “participating provider”? In this case, by contracting with Regence as an out-of-network but also participating provider, Swedish straddled the line between being in and out of network – designations that traditionally indicate whether a provider has a contract with an insurer or not.

The broader contract allowed Swedish to bill members of any Regence plan who receive out-of-network services there 50% coinsurance – the patient’s portion of the overall cost the insurer allows the provider to charge – with no out-of-pocket maximum for the patient.

It was only after Regence was contacted by KHN that the insurer explained its reasoning to the reporter: Regence said the Swedish hospital, while out of network for Danielle, had a broader contract with the insurer as a “participating provider” and so the insurer was not in violation of surprise-billing laws by approving Swedish’s out-of-network coinsurance charges.

The Takeaway: More than a year after the federal surprise-billing law took effect, patients can still get hammered by surprise bills resulting from health plans’ limited provider networks and ambiguities about what is considered emergency medical care. The loopholes are out there, and patients like Laskey are just discovering them.

...patients can still get hammered by surprise bills resulting from health plans’ limited provider networks and ambiguities about what is considered emergency medical care.

...patients can still get hammered by surprise bills resulting from health plans’ limited provider networks and ambiguities about what is considered emergency medical care.

Washington state Rep. Marcus Riccelli, chair of the House Health Care and Wellness Committee, said he will ask the state’s public and private insurers what steps they could take to avoid provider network gaps and out-of-network billing surprises like this. He said he will also review whether there is a loophole in state law that needs to be closed by the legislature.

Bruce Alexander, a CMS spokesperson, said the Departments of Health & Human Services, Labor, and Treasury are looking into this issue. While the agencies can’t predict whether a new rule or guidance will be needed to address it, he said, “they remain committed to protecting consumers from surprise medical bills.”

Congress might have to fix the problem, since the federal agencies that administer the No Surprises Act may not have authority to do anything about it, he added.

Fiedler said policymakers need to consider addressing what looks like a major gap in the new laws protecting consumers from surprise bills, since it’s possible that other insurers across the country have similar contracts with hospitals. “Potentially this is a significant loophole, and it’s not what lawmakers were aiming for,” he said.

In the meantime, patients, even in emergencies, should ask their doctors before a hospital admission whether the hospital is in their plan network, out of network, or (watch for these words) a “participating provider.”

KHN (Kaiser Health News) is a national newsroom that produces in-depth journalism about health issues. Together with Policy Analysis and Polling, KHN is one of the three major operating programs at KFF (Kaiser Family Foundation). KFF is an endowed nonprofit organization providing information on health issues to the nation.

As the Laskeys discovered, hospital billing departments may offer little help in resolving surprise billing. So, while it is worth contesting questionable charges to the provider, it’s also usually an option to quickly appeal to your state insurance department or commissioner.

Bill of the Month is a crowdsourced investigation by KHN and NPR that dissects and explains medical bills. Do you have an interesting medical bill you want to share with us? Tell us about it!

Have You Put Off Medical Treatment Because of the High Cost?

American’s are putting off accessing medical treatment, even for serious chronic conditions, more than ever before. The reason for this is they fear the high cost of actually using their health insurance and whether, their doctor recommended procedures will even be approved by insurers only looking at their bottom line.

American’s are putting off accessing medical treatment, even for serious chronic conditions, more than ever before.

American’s are putting off accessing medical treatment, even for serious chronic conditions, more than ever before.

A poll done in early January of 2023 found that 38 percent of respondents put off scheduled medical care due to cost. That is more than one out of every three respondents. That is a 12 point increase over the last two years. Why is this happening?

Individual and family plans, under the Affordable Care Act, back in 2014 when healthcare.gov and other state based exchanges became the way most Americans who were not offered coverage through an employer plan or federal or state programs, had an out of pocket maximum of $6,350 per individual and $12,700 per family. An out of pocket maximum is the amount reached by one person, or the entire family, before all covered services will be paid by the insurer at 100% for the remainder of that calendar year. There have been steady increases every year since then, including during the pandemic years of 2020 through 2022; and in 2023 the out of pocket maximum is now $9,100 for an individual and $18,200 per family. That is a 43% increase in the cost of accessing medical services under the AFFORDABLE CARE ACT! On January 4th of 2023 it was already announced that in 2024, the out of pocket maximum will be $9,450 for an individual and $18,900 for a family. These out of pocket maximums are also seen in employer based coverage as well. Why is that information not being talked about more by the news media and politicians? It is hard to call this, along with exorbitant premiums, AFFORDABLE.

That is a 43% increase in the cost of accessing medical services under the AFFORDABLE CARE ACT! ... It is hard to call this, along with exorbitant premiums, AFFORDABLE.

That is a 43% increase in the cost of accessing medical services under the AFFORDABLE CARE ACT! ... It is hard to call this, along with exorbitant premiums, AFFORDABLE.

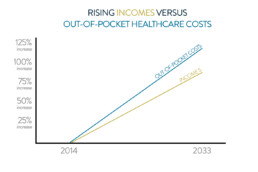

In an article dated July 20, 2022, in the Peterson KFF Health System Tracker, between 2014 and 2033 wages are expected to rise by 83% and that sounds amazing. Unfortunately for your health, the Affordable Care Act out of pocket maximum is expected to rise by 122 percent in that same time period!

How does this affect seniors on Medicare Advantage Plans?

We have all seen the commercials talking about $0 premium plans being sold to us by insurers, using older nostalgic stars of the past, telling seniors that they can get all their medical care under one roof using a Medicare Advantage Plan. They tout $0 premium plans that offer a $0 copay for a primary care physician, have dental, routine vision and routine hearing coverage , prescription drug coverage, PART B buybacks (even though most of the plans don’t offer them or only give $10 or $20 as a benefit), free food (usually only available on Dual Eligible Medicare Medicaid Plans – but advertised as if that was available for all), and more.

What they DON’T mention is the allowed out of pocket maximum. That means the amount of money that a person, with a Medicare Advantage plan, will have to pay out of their own pocket before all their medical bills will be paid by their private insurer at 100% for the remainder of the year. For 2023 that can be as high as $8,300 per person, and that figure does not include prescription drug costs, dental, routine vision, routine hearing, or any other costs that would not be covered under Original Medicare Parts A and B! This has risen steadily from 2020, when the allowed out of pocket maximum was $6,700 per person. $8,300 plus all those other costs for prescription, dental, etc. for people on a fixed income is not keeping up with the 8% inflation rate!

Medicare Supplement Plans, such as the very popular “G” plan in 2023 have an out of pocket costs of $226 for the year, on medical expenses only (those services covered by Part A and Part B under Medicare).

Medicare Supplement Plans, such as the very popular “G” plan in 2023 have an out of pocket costs of $226 for the year, on medical expenses only (those services covered by Part A and Part B under Medicare).

Medicare Supplement Plans, such as the very popular “G” plan in 2023 have an out of pocket costs of $226 for the year, on medical expenses only (those services covered by Part A and Part B under Medicare). Unfortunately, those are not the plans being given so much air time in television commercials, billboards, and mailings. Ask yourself, if you know that a medical service is going to cost you very little or nothing (maximum of $226.00 on all Part B Services and $0 on all covered Medicare Part A Services for the entire year) are you more likely to access the medical treatment that you need than if you have a plan that has an out of pocket maximum of $8,300 for the year on all those same covered services? And, those who think that they are healthy now so take a Medicare Advantage Plan initially, believing that their will be an ANNUAL ENROLLMENT PERIOD each year, where they can join a Medicare Supplement Plan (with no health questions asked) are SHOCKED to find out that they cannot do that , due to medical underwriting, when they develop chronic health conditions later on in life as they age. This is an inevitability for almost everyone.

It becomes incredibly clear why people are not keeping up with their healthcare appointments and putting off the cost of needed treatments. It is so incredibly important that people make noise about what the medical plans offered to them really cost and the best way to do that is to contact your local representatives in CONGRESS and contact the news media. Health coverage should be a right enjoyed by all and not just for those who can afford it!

It is so incredibly important that people make noise about what the medical plans offered to them really cost and the best way to do that is to contact your local representatives in CONGRESS and contact the news media.

It is so incredibly important that people make noise about what the medical plans offered to them really cost and the best way to do that is to contact your local representatives in CONGRESS and contact the news media.

Opportunities To Save MONEY on Family Health Plans in 2023

Has this happened to you? As an employee you have been offered coverage through your company health plan, and the employer is paying a portion, up to 100% of your coverage, and that coverage is also open to your spouse and children – but they had to pay as much as 100% of the premium. Affordability of employer health insurance for family members was based on the cost to enroll only the employee, regardless of the cost of family coverage. Even if the cost to enroll family members was significantly more than the cost to enroll the employee, the coverage was still considered “affordable” for the family members, making them ineligible for financial assistance through marketplaces like Pennie. That hit many people’s bank accounts very hard each month. In 2023 that has changed for the better!

The New Solution

Under this new rule, starting with 2023 coverage, family employer plans will only be considered “affordable” if the actual cost to enroll each member of the family is within the ACA affordability standards. In other words,

...when employer coverage for family members costs too much, the family members may qualify for financial assistance through Pennie, instead of being forced to pay full price.

...when employer coverage for family members costs too much, the family members may qualify for financial assistance through Pennie, instead of being forced to pay full price.

Pennie’s application has been updated to include a new question for all members of a tax household with an offer of family coverage through a spouse or parent’s employer. Each tax dependent will be asked to provide the premium of the lowest cost family plan (employee + spouse + other dependents). Pennie will then determine for each family member whether that employer coverage is affordable to determine whether each person may be eligible for savings through Pennie. The employer coverage may be affordable for some family members but not others, resulting in only some family members being eligible for financial savings.